Key Points:

- Setting a budget is foundational for achieving financial stability, as it helps you live within your means, identify spending patterns, and make informed financial decisions.

- Paying off high-interest debts should be a priority. Using strategies like the avalanche method can help manage and eliminate debt more efficiently.

- Automating your savings makes the process easier and more efficient, ensuring that you prioritize saving over non-essential spending.

- Investing in the stock market can offer substantial long-term returns. For beginners, starting with low-cost, broad-market index funds and diversifying your portfolio is advisable.

- Reinvesting dividends and capital gains can significantly boost your earnings over time, contributing to long-term financial stability.

- Distinguishing between needs and wants is crucial for avoiding unnecessary debt and managing money effectively.

- Financial stability is a long-term goal, and the earlier you start employing these strategies, the more you’ll benefit in the future.

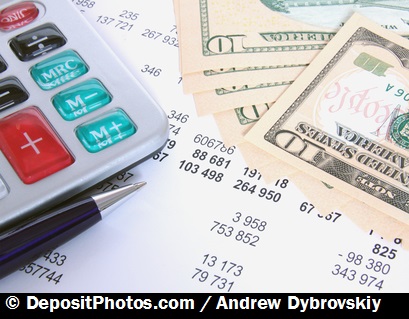

Managing money effectively and saving wisely are two essential skills often overlooked in our formal education. Yet, they are critical pillars in ensuring financial stability and a secure future. This article provides insight into effective money management strategies to help you maintain financial stability, as well as proven methods that boost savings and secure your future.

Essential Money Management Strategies for Financial Stability

The first step towards financial stability is setting a budget. A detailed budget permits you to track your income and expenditures, ensuring you live within your means. It also helps identify spending patterns, highlight non-essential expenses, and guide you towards making better financial decisions. There are several budgeting tools and apps available that can tailor your budget to your specific financial lifestyle. A balanced budget is the backbone of sound financial planning.

The second strategy is paying off debt as soon as possible. Debts, especially those with high-interest rates such as credit cards, can quickly snowball, leaving you financially strained. To prevent this, prioritize paying off your most expensive debts first, while still paying the minimums on your other debts. This strategy, known as the avalanche method, can save you money over time. It is also crucial to avoid unnecessary debt by distinguishing between needs and wants, thereby effectively managing your money.

Proven Methods to Boost Savings and Secure Your Future

One proven method to boost savings is to automate them. Setting up automatic transfers from your checking account to your savings account can make the process of saving easier and more efficient. This method, often referred to as “paying yourself first,” ensures that money goes into savings before it can be spent on non-essential things. Additionally, you can take advantage of automatic increases in your employer-sponsored retirement account to gradually increase your savings rate over time.

Investing is another robust method to secure your future. While it might seem intimidating at first, investing in the stock market can yield substantial returns over time. Diversifying your portfolio and investing in low-cost, broad-market index funds can be a good starting point for beginners. It’s also beneficial to reinvest dividends and capital gains, which can significantly boost your earnings over time. Always remember that while investing involves some risk, not investing may actually pose a greater risk due to inflation and the declining purchasing power of money.

In conclusion, effective money management and smart savings strategies are essential for financial stability and a secure future. By setting up and adhering to a budget, paying off debt, automating savings, and investing in the stock market, you can take control of your financial health. Remember, the journey to financial stability and wealth is a marathon, not a sprint. The earlier you start, the greater the benefits you will reap in the future.