Key Points:

- Understanding your financial goals, risk tolerance, and investment timeframe is critical for effective investing.

- Diversification across various asset classes is a cornerstone of modern investment strategies, reducing risk and potentially increasing long-term returns.

- Regular portfolio rebalancing ensures that your investments align with your risk profile and investment objectives.

- Staying informed about the economic environment through indicators like inflation rates, GDP growth, and unemployment rates can help guide your asset allocation.

- Your personal financial situation—such as income, expenses, debts, and financial goals—should inform your investment choices.

- Establishing an emergency fund should be a prerequisite before diving into investment, providing a financial cushion for unforeseen circumstances.

- Dollar-cost averaging, which involves investing a fixed sum regularly, can mitigate the effects of market volatility and potentially offer better long-term returns.

- Investing in today's financial landscape requires patience, discipline, and a well-structured strategy for success.

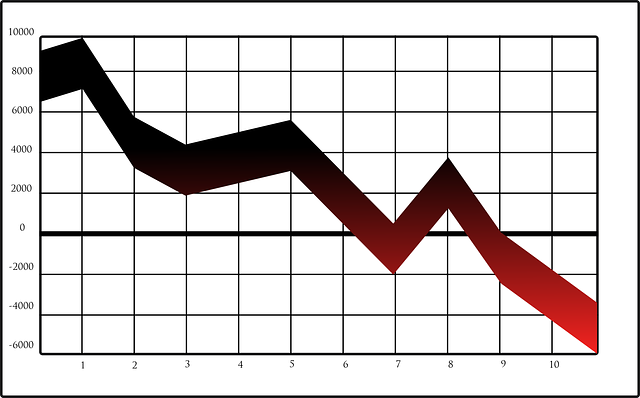

In today's ever-changing financial landscape, sound investment strategies are indispensable for managing money effectively. With the tumultuous stock markets, fluctuating interest rates, and the potential for both inflation and deflation, understanding effective money investment strategies and knowing how to allocate your finances becomes even more crucial. This article will delve into the fundamentals of modern investment strategies and provide tips on how to effectively allocate your money in today's market.

Understanding the Fundamentals of Modern Investment Strategies

The bedrock of any successful investment strategy is a thorough understanding of your financial goals, risk tolerance, and investment timeframe. These three factors are integral in shaping your investment plan and determining which assets you should include in your portfolio. For instance, if you are a risk-averse investor with a short-term investment horizon, then conservative investment vehicles like bonds and money market funds might suit you. On the other hand, if you are a risk-tolerant investor with a long-term horizon, then you might consider more aggressive investment options such as equities and real estate.

Moreover, diversification is another essential aspect of modern investment strategies. This involves spreading your investments across different asset classes to mitigate risk. The idea is not to put all your eggs in one basket but rather to distribute them across various sectors and markets. By doing so, if one investment performs poorly, the others might perform well, thereby balancing out the overall performance of your portfolio. Furthermore, regular portfolio rebalancing can help ensure that your asset allocation aligns with your risk tolerance and investment objectives.

How to Effectively Allocate Your Money in Today’s Market

Allocating your money in today's market requires a good understanding of both the economic environment and your personal financial circumstances. Firstly, it's important to regularly monitor the state of the economy. This can involve keeping an eye on indicators such as inflation rates, GDP growth, unemployment rates, and industry trends. These indicators can give you an idea of how different asset classes might perform and thereby guide your investment decisions.

Secondly, consider your personal financial situation. This involves your income, expenses, savings, debts, and financial goals. You should aim to invest money that you can afford to set aside for a considerable amount of time. Also, avoid investing money that you might need in the near future. Furthermore, be sure to establish an emergency fund before starting to invest. This can act as a safety net and give you the confidence to make investment decisions without the fear of immediate financial constraints.

Finally, in allocating your money, it's important to diversify across different asset classes and sectors. This can help spread the risk and potentially yield better long-term returns. Also, consider the benefits of dollar-cost averaging, which involves investing a fixed amount of money at regular intervals regardless of the price. This strategy can help mitigate the impact of volatile market conditions and could potentially yield better long-term returns.

In conclusion, understanding the fundamentals of modern investment strategies and effectively allocating your money are vital steps towards successful investing in today's market. By defining your investment objectives, risk tolerance, and investment horizon, you can build an investment strategy that is tailored to your needs. Also, by keeping abreast of the economic environment and considering your personal financial situation, you can make informed decisions on how to allocate your money. Remember, investment requires patience, discipline, and a well-devised strategy. With these, you can navigate through the financial market and grow your wealth over time.